|

|

|

|

|

|

|

|

Merchant Account TypesMerchant Account ProvidersNews & AdviceMerchant Account Tools |

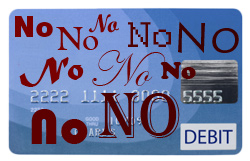

Print Print  Email Email Study: Consumers affected by debit card fees will likely turn to creditConsumers across the country will soon be charged a monthly fee for using their debit card and the effects are likely to trickle down to merchants, according to a recent study.

A September 2011 study by the Federal Reserve Bank of Boston found that consumers are more likely to respond to new debit card fees by pulling out their credit card instead.

Study: Consumers' payment choice is influenced by cost But according to the September 2011 study, debit card usage is closely tied to the perceived cost of using a debit card. If the cost of using a debit card rises, then consumers will likely choose another payment method, such as cash or credit, reports the Federal Reserve Bank of Boston. Although some consumers may choose to pay in cash or with checks (or simply switch banks), many are projected to turn to credit cards for at least some of their purchases. "Credit cards were viewed as the closest substitute for debit cards," wrote lead author Joanna Stavins. "If the cost of using debit cards rises, consumers are more likely to substitute credit cards for some of their debit card transactions." As a result, merchants could wind up processing a higher number of credit cards, which are costlier to process.

How your customers are being affected

by the new fees

Here's a brief look at how some of your customers are being affected by banks' new fees:

The Durbin amendment only impacts big banks -- defined as having $10 billion or more in assets, according to the Dodd-Frank Financial Reform Act. But the smart money in consumer finance circles say that banks won't stop with debit card fees. Debit account rewards programs may also be curbed or cancelled. The new fees have drawn ire from consumer advocates and retailer advocates alike. "Every time Congress takes a step to protect consumers, the banks use it as an excuse to raise fees," said Mallory Duncan, a senior vice president at the National Retail Foundation, in a statement. "We've seen it when Congress limited late fees and overdraft fees and now we're seeing it with swipe fees. Just as merchants and consumers are about to get some relief, they're doing it again. That doesn't mean Congress shouldn't pass consumer protection laws. It speaks more to the nature of the card industry than to whether swipe fee reform should have been passed." See related: Few plan to steer customers to debit; Fighting high card processing fees with store debit cardsPublished: October 19,2025Comments or Questions, Library of Stories

|

|||||||||||||